Business

Petrol Scarcity Threatens as NNPC Faces $6bn Debt Crisis

The NNPC’s battle with a $6 billion debt could lead to a nationwide petrol shortage, causing widespread concern among Nigerians.

Concerns are on the rise regarding a possible increase in petrol, also known as premium motor spirit, at fuel stations throughout Nigeria.

The Nigerian National Petroleum Company Limited (NNPC) has officially recognized that it is experiencing substantial financial difficulties as a result of its $6 billion debt.

On Sunday, the NNPC finally acknowledged its substantial debt to petrol suppliers after weeks of denying the issue.

According to Olufemi Soneye, the Chief Corporate Communications Officer of the state-owned energy giant, the company’s finances have been significantly affected by its debt, particularly with regards to covering petrol supply expenses.

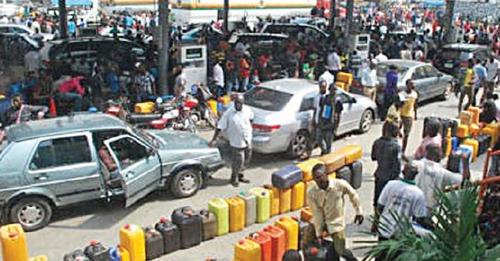

The NNPC’s statement implied that the increasing debt is a significant factor behind the current fuel queues observed at filling stations all over the nation.

The financial burden is impacting the company’s capability to maintain a consistent petrol supply, worsening the predicament.

In July, the OBASANJONEWS had reported that Nigeria owed more than $6 billion to its petrol suppliers. This huge debt left the NNPC grappling with the challenge of balancing fixed pump prices against unpredictable international fuel costs.

According to a Reuters report, the struggle of the national oil company commenced in early 2021 as its outstanding PMS payments exceeded $3bn.

Traders have reported that the company has yet to settle payments for certain January imports, resulting in an accumulating debt. NNPC is contractually obligated to make payment within 90 days of delivery.

According to an industry source, the sole motivation for traders tolerating this situation is the compensation of $250,000 per cargo each month for delayed payments.

According to traders, Nigeria’s PMS purchase offers have reduced in size since June.

As of now, a total of five traders who haven’t been paid have stopped supplying PMS to the NNPC. Three additional traders joined the initial two who ceased operations in July.

However, Soneye refuted claims in August that the NNPC had a debt of $6.8 billion owed to international oil traders.

According to the spokesperson, NNPC Ltd has no outstanding balance of $6.8bn with any international traders. In oil trading operations, credit transactions are common and can sometimes result in unpaid bills for a certain period of time. Nonetheless, NNPC Trading – one of its subsidiaries – holds several open trade credits with multiple vendors that it diligently honors on a first-come-first-served basis.”

Despite attributing the prolonged fuel scarcity to factors such as unfavorable weather conditions and difficulties in dock handling, among others, none of NNPC’s efforts have so far resolved the long queues at gas stations.

The company backtracked on Sunday by acknowledging that it was dealing with financial constraints.

Read Also: Atiku Calls for Immediate Listing of NNPCL on Stock Exchange in Accordance with PIA

Recent reports in national newspapers regarding NNPC Ltd’s substantial debt to petrol suppliers have been acknowledged by the company.

In a statement titled “NNPC Ltd Faces Financial Strain Due to PMS Supply Costs, Impacting Supply Sustainability,” Soneye expressed that the company is under substantial pressure as a result of financial strain and faces an imminent threat regarding fuel supply sustainability.

He further stated that the corporation was working hand in hand with pertinent government bodies and other interested parties to sustain an even distribution of petroleum commodities throughout the country.

Dedicated to its responsibility as the ultimate supplier, ensuring national energy security in compliance with the Petroleum Industry Act is NNPC Ltd’s top commitment.

We are working in close partnership with pertinent government bodies and other interested parties to uphold an uninterrupted distribution of petroleum products throughout the country.

Since July, the fuel crisis in Nigeria has been ongoing and Nigerians have expressed their dissatisfaction. Recently, NNPC admitted to a claim it had previously denied; this admission sparked speculation that the Federal Government might discontinue paying for what they refer to as “under-recovery” or imported petrol shortfall payments.

According to OBASANJONEWS, the company is rumored to be considering a viable solution to address their mounting debts by ceasing payment of unsustainable shortfalls.

According to operators, if this occurs, the cost of gasoline will exceed N1,000. Accredited marketers who are interested would then be allowed to import petrol and eliminate NNPC’s monopoly.

Subsidies are paid by FG.

The NNPC, which is the only importer of petrol at present, has disclosed that the current price for PMS set by marketers at N1.117 per litre benefits from subsidy support provided by the Federal Government.

Despite denying the payment of fuel subsidies to marketers in the past nine years, NNPC admitted that it was permitted by the government to sell at a price lower than its landing cost.

During the presentation of its 2023 report in Abuja, Alhaji Umar Ajiya, the company’s Chief Financial Officer revealed this information.

For the past eight or nine years, NNPC has not disbursed any funds as subsidy payments; nobody has been compensated a single penny by NNPC under this category. None of our marketers have been beneficiaries of subsidization through receipt of monetary reimbursements from us.

“We have been importing PMS at a specific cost price and the government mandates us to sell it at half that price, resulting in a shortfall between the landing cost and selling rate.”

According to him, “The arrangement is for the Federation and NNPC to come to an agreement. Occasionally, they provide us with funds; thus no marketer receives subsidies in cash.”

According to him, credit lines were widely used in downstream industries due to the global commercial structure.

He stated that the company had previously entered into an open credit agreement with PMS suppliers, which included term-line contracts for payment.

Additionally, Dapo Segun – the Executive Vice President of NNPCL’s downstream sector- expressed that by creating transparent credit deals with suppliers, it was evident how much credibility the national oil company had amassed throughout its span.

The outstanding balance owed to suppliers is actually lower than the previously reported $6.8 billion magnitude.

The crucial factor is the bond we share with our suppliers, as it guarantees that we continue to fulfill our payment obligations. This commitment has been honored by us consistently over a period of time.

He stated that the figure is not fixed, and he preferred not to provide a specific amount. As payments are made, it decreases, while product supplies increase it. The situation is ever-changing; however, the critical goal remains to guarantee availability of PMS nationwide.

The NNPC is the sole importer of petrol and receives payment from the Federal Government to provide fuel at a discounted rate to Nigerian citizens.

The perpetual increase in debt owed to international oil companies has caused a continuous lack of fuel throughout the country.

President Bola Tinubu made an announcement on May 29, 2023 that the fuel subsidy had been abolished.

The rise in the cost of imported petrol due to naira’s floating left an average Nigerian unable to afford it. As a result, the Federal Government intervened by limiting its price below landing costs and covering any deficits.

Fuel importation is being impacted by the Federal Government’s failure to pay the shortfall.

The Nigerian government was advised by the International Monetary Fund in May to abolish fuel and electricity subsidies that were deemed implicit.

The IMF’s report warned Nigeria that subsidies would consume 3% of its Gross Domestic Product in 2024, up from the previous year’s estimate of only 1%.

The IMF praised the Federal Government for its initiative in eliminating “expensive and disadvantageous energy subsidies” as stated by a report. This crucial move enables fiscal space to be created, enabling development spending to take place whilst strengthening social protection alongside maintaining debt sustainability.

The IMF pointed out that following Tinubu’s removal of subsidies, there was a failure to promptly implement sufficient compensatory measures for the disadvantaged. Furthermore, corruption concerns led to these efforts being put on hold. In order to assist Nigerians in managing high inflation and currency devaluation, implicit subsidies were reintroduced by setting pump prices below cost up until 2023’s end.

The IMF’s advice seems to have finally gotten through to the Federal Government.

“Deregulation partly responsible for fatalities”

Hammed Fashola, the National Vice Chairman of Independent Petroleum Marketers Association of Nigeria has urged the government to completely remove or reintroduce fuel subsidy instead of engaging in partial deregulation.

To resolve the issue at hand, it is recommended that the Federal Government and NNPC completely deregulate. The current disparity between NNPC retail selling at N580 in Lagos versus independent marketers selling at N800 is detrimental to our business progress. This gap must be closed for us to succeed.

Fashola emphasized that if the Federal Government intends to reinstate subsidies, they should do so comprehensively and not just for NNPC Retail. This way, everyone will be aware of their subsidized usage. However, Fashola believes this move may negatively impact the economy of Nigeria.

He declared that the difference in prices is unfavorable for independent marketers’ reputation, asserting that the general public lacks comprehension regarding their pricing strategy.

He stated that people often view us as bad, but we are trying to educate them and make them aware that it is not our fault.

According to the IPMAN leader, the shortage of fuel is due to NNPC remaining as the sole importer of PMS.

He stated that the challenge lies in the fact that only NNPC has the ability to provide this product due to forex restrictions, making them exclusive sellers. Although a few independent marketers attempted importing before, they were unsuccessful.

Fashola emphasized the need to confront reality and eliminate subsidies so that a fair competition among all companies can be achieved. He stated that they are not asking for preferential treatment towards NNPC Retail, as it would only lead people to view them negatively like greedy businessmen.

During a fuel crisis that has lasted approximately two months, our correspondent noted persistent price increases in filling stations operated by independent marketers.

Starting from less than N700 back in July, the price of petrol has consistently climbed and now sits at over N900 per litre across most fuel stations by the end of August. Unfortunately, there have been no effective measures taken to curb this continuous upward trend as it persists till date.

The passenger haggling over the transportation fee on the Lagos-Ibadan Expressway was informed by a visibly irate bus conductor that he had just purchased one liter of petrol for N980 in Ogere.

Major marketers such as NNPC Retail, Mobil, MRS, Conoil, Ardova and TotalEnergies sell their product below N700 in filling stations. However, long queues of motorists struggling to purchase fuel are common at these locations.

Over the weekend, it was noticed that a lot of notable marketers such as NNPC provided limited services due to unstable fuel provision.

On multiple occasions, Olufemi Soneye, the spokesman for NNPC, assured The OBASANJONEWS that the fuel queues witnessed nationwide would dissipate within a few days.

Despite promises, Nigerians are still struggling for energy security in the transportation sector as they continue to experience inadequacies.

Our correspondent was informed by a depot operator that the increase in price can be attributed to the desperation of marketers to acquire PMS.

According to the operator, who chose to remain anonymous in print, a lot of marketers are competing fiercely and willing to purchase at any cost since they’re confident that selling it for a higher price would yield profits.

However, the operator argued that the scarcity of adequate supply is to blame for the distressing situation. They stated that several depots have been depleted of stock for several weeks.

According to the source, it is usually not the depot owners who increase prices but rather marketers competing with each other at the depots.

According to our correspondent, certain intermediaries who connect depots and filling stations only sell their products to the highest bidders while ignoring those who cannot afford it.

It was discovered that these intermediaries generate profits merely by using phone calls to bargain with the gas stations for prices.

Our correspondent was informed by another depot source that the loading of fuel had shown improvement over the weekend, and there is hope for further improvements in the coming week.

According to the source, there was an improvement in loading during the weekend. The supply is predicted to increase and loading activities took place on Saturday and Sunday. There is optimism that the fuel situation will progress throughout this week.

Despite claims of improved loading of fuel, Nigerians are still experiencing high rates when purchasing fuel according to our correspondent.

According to OBASANJONEWS’ findings, the cost of transportation has increased by approximately 40 percent, varying based on the location.