Nigeria

Nigerian government grants approval for 499 licences to trade solid minerals

499 licences for the purchase and sale of solid minerals in Nigeria in 2023 have been approved by the Federal Government through the Ministry of Solid Minerals Development.

Read Also: Underperforming DisCos and GenCos in Nigeria will have their licences revoked- Adelabu

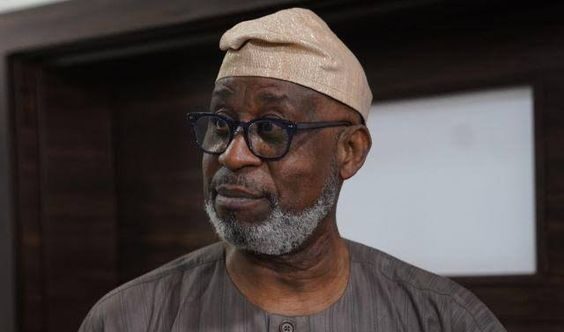

The Minister of Solid Minerals event, Dele Alake, disclosed this event on Tuesday at the BusinessDay Solid Minerals Conference in Abuja, where he served as the keynote speaker.

“The Ministry is still making it easier to submit applications for permits to buy, process, and refine minerals. According to him, 499 licences were given to applicants engaged in the buying and selling of minerals last year.

With 146 permits, applications for the purchase and sale of lithium topped the list as expected. Gold (91), tin (46), and coal (32) were the next most popular categories. Licences were also given for the following minerals: aquamarine, baryte, columbite, mica, kaolin, feldspar, beryl, tantalite, and iron ore.

Additionally, he revealed that the Nigerian Solid Minerals Corporation’s N1 billion share capital will be owned by the Federal Government to the tune of around 25%.

He also mentioned that the process of drafting the institution’s laws had started.

According to Alake, private investors may purchase up to 10% of the remaining shares, with Nigerian citizens holding the remaining 25% of the total shares.

“The creation of a Nigerian Solid Minerals Corporation driven by the private sector is central to our efforts to reposition the sector,” he stated. This comes as the minister said that the process of drafting the institution’s laws has started. The House of Representatives’ Solid Minerals Committee will convene its first policy dialogue on the proposed corporate creation law on February 12 and 13, 2024.

“We are determined to ensure that a share structure in line with a private sector-led strategy is achieved, working with the legislature to establish the legal and legitimate foundation for the institution. The Federal Government will hold no more than 25% of the shares of the N1 billion share capital, while Nigerian citizens will hold 25% through public shares and private investors will have a maximum of 10% each.”