Business

CEO: Nigerian Crude Would be Processed at the Dangote Refinery

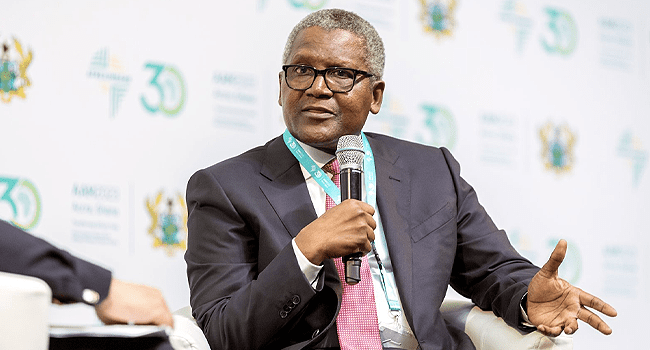

Alhaji Aliko Dangote, the President and Chief Executive of Dangote Group, has affirmed that his $20bn refinery project known as Dangote Petroleum Refinery was specifically constructed to refine Nigerian crude oil while creating additional value for it domestically.

In a statement released by the refinery on Thursday, Dangote expressed his confusion as to why the plant should divert from its main focus. He acknowledged that they had also processed crude oil grades sourced from Europe, America and other nations.

The richest man in Africa added that the problems related to Nigeria’s local crude oil supply were being resolved by those involved.

As per the statement, Nigerian cargoes are still in-country and comparable light, sweet grade US WTI Midland is being imported due to the impact of the refinery. This suggests that there could be a potential tightness in the market for light, sweet crude as a result of this mega-refinery.

The quote from a West African crude trader to Commodity Insights mentioned that the diet of this particular commodity is mostly composed of WTI and lighter Nigerian oil, meaning if one were pursuing these barrels, they would most likely feel its impact significantly.

At first, WTI Midland crude was chosen as the preferred supplementary feedstock for Nigerian supply by noting its competitive pricing. The refinery has signed long-term contracts to acquire this grade from the US.

Other markets, notably Europe – the biggest light, sweet Nigerian crude consumer- have experienced the impact of Dangote refinery’s influx and outflow.

In its statement, the multi-billion dollar company disclosed that 30% of the crude delivered to Dangote was from US grade through 18 cargoes.

According to the statement, Dangote announced that incorporating Libyan, Angolan and Brazilian crude would expand the refinery’s range of feedstock sources.

Dangote emphasized that the refinery’s primary goal is to utilize Nigerian crude and enhance its value domestically, so there is no reason to stray from this objective. He also mentioned that they are actively resolving any problems with the supply of crude but keeping an open mind about supplementing it through other opportunities.

According to Rasool Barouni, who is the Associate Director and leads Refining at S&P Global Commodity Insights, the Dangote refinery can handle various light and medium crude oil grades such as those found in Nigeria. He added that it could also potentially process other comparable Western African (WAF) grades.

According to the Platts OPEC Survey from S&P Global Commodity Insights, Nigeria produced 1.5 million barrels per day in June making it the largest oil producer in sub-Saharan Africa.

Previously, the absence of any refining ability obliged all oil to be exported prior to this year. Imported gasoline, diesel and jet fuel were utilized for domestic purposes.

According to the statement, OPEC stated that Europe’s oil industry, particularly Northwest Europe gasoil, would face performance challenges due to supplies from Dangote Refinery and Petrochemicals.

According to the June 2024 monthly Oil Market Report by OPEC, Dangote refinery was listed as a major supplier of diesel and jet fuel that would cause disruption in Europe’s oil and gas industry. This development is predicted by experts to have a beneficial impact on the Nigerian economy.

It is worth remembering that according to Standard & Poor Global, as well as trading and ship tracking sources, Nigeria’s Dangote refinery – valued at $20bn – is expected to significantly disrupt global crude flows when it operates at full capacity. The refinery has already caused an impact since becoming operational in January of this year, with data from both trading sources and ship tracking confirming the same.

The Dangote refinery has provided further clarification regarding its position on the supply of crude to the facility.

Media reports have claimed that the Dangote refinery acknowledged receiving 60% of the 50 million barrels from NNPC, which has caught our attention.

To make it clear, we have never alleged that NNPC hasn’t provided us with crude. Our apprehension has continually been NUPRC’s unwillingness to uphold the obligation of supplying domestic crude and guaranteeing our access to complete required amounts from both NNPC and IOCs.

In September, we need a total of 15 cargoes. However, only six have been allocated by NNPC and despite our appeals to NUPRC, we haven’t managed to secure the rest. When reaching out to IOCs operating in Nigeria for assistance with this matter they either redirected us towards their external trading arms or told us their cargoes are already reserved.

The refinery declared on Thursday that they frequently procure identical Nigerian crude from global traders at an extra $3-$4 premium for each barrel, amounting to $3-$4 million per cargo.